Date: October 13, 2025

Author: IXS Finance Editorial Team

The Crash That Shook Crypto’s Foundations

October 10, 2025, will be remembered as one of crypto’s bloodiest days. A flash crash ignited by the U.S. President Trump’s surprise 100% tariff announcement on China triggered a global risk-off panic.

Within hours, $19 billion in leveraged positions were wiped out, marking the largest liquidation event in crypto history.

- Bitcoin plunged 13% in under an hour.

- Ethereum followed with a 16% drop.

- Layer-2s like Optimism and Arbitrum crashed over 30%.

- More than 1.6 million traders were liquidated in less than 24 hours.

The total market cap bled over $560 billion in just two weeks.

Crypto veterans have seen volatility before but this was a sobering reminder that correlation, not diversification, still defines most portfolios.

The Silver Lining: RWAs Hold the Line

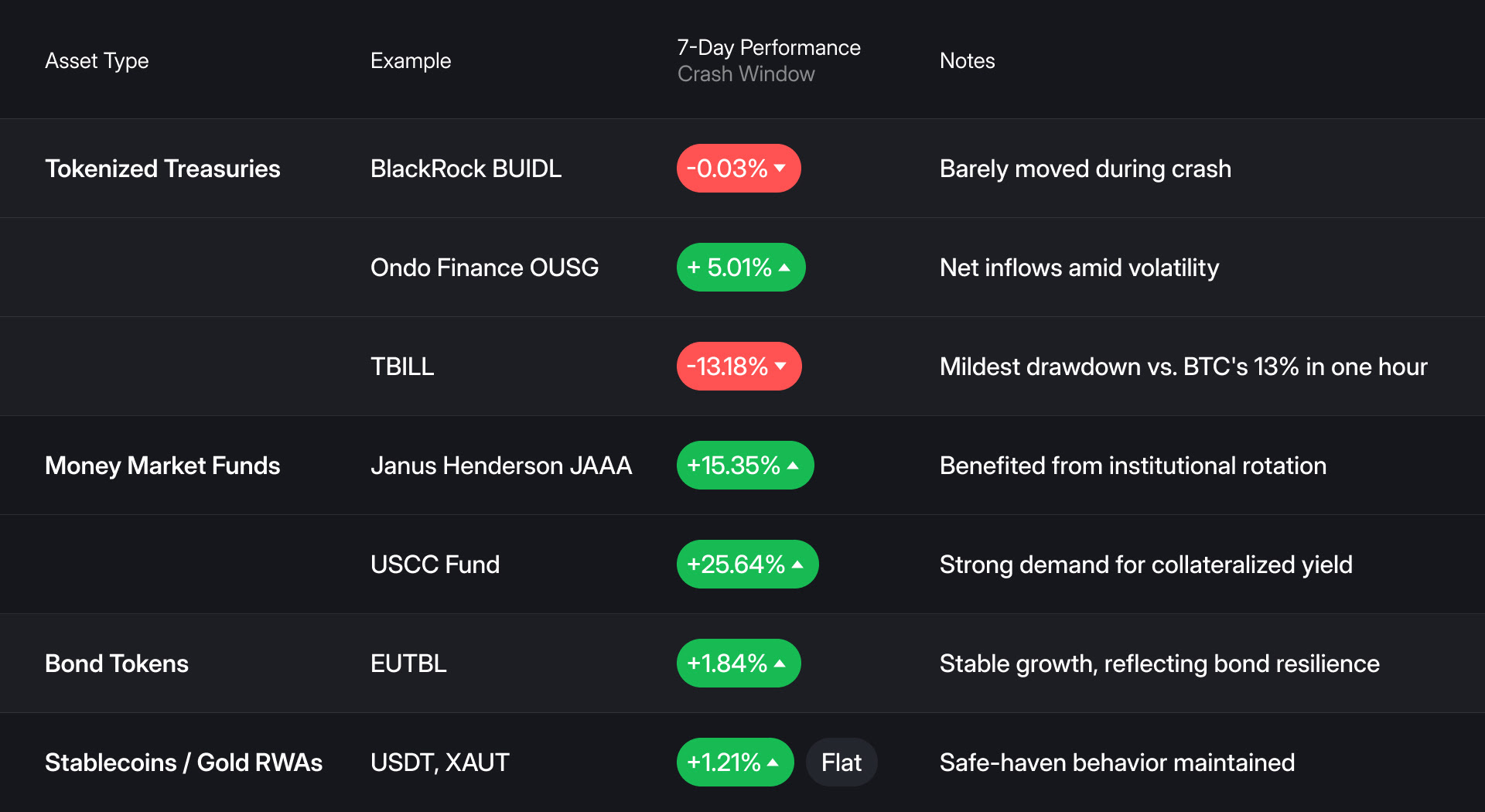

Amid the wreckage, Real World Assets (RWAs) quietly did what they were built to do to provide a stabilizing counterweight. These blockchain-based representations of traditional assets Treasuries, bonds, and money market funds didn’t just survive the storm. They thrived in it.

According to RWA.xyz, the tokenized RWA market actually grew by 10.22% during the same 30-day window that saw crypto implode. The total on-chain RWA ecosystem now sits at $33.73 billion.

While the average crypto asset fell by double digits during the window, RWA price moves stayed under ~2%, delivering ~70–80% less drawdown compared to the overall crypto market.

Why RWAs Are Structurally Resilient

RWAs aren’t magic, they're architecture. They inherit TradFi’s stability while leveraging Web3’s transparency and efficiency.

Three factors underpin their strength:

- Collateral Quality: RWAs are backed by instruments like U.S. Treasuries, short-term bonds, or AAA-rated commercial paper, not speculative narratives.

- Regulated Frameworks: Platforms like IXS Finance, licensed under the DARE Act (Bahamas), ensure that token issuance, custody, and settlement are fully compliant and auditable.

- Institutional integration: RWAs connect fragmented liquidity pools banks, funds, and exchanges on one side; DeFi protocols on the other so capital can move through one programmable, compliant rail.

This isn’t hypothetical; it already lives across tokenized fixed-income markets, where issuance, custody, and settlement plug directly into on-chain workflows.

Fixed income as a diversifier: how it behaves

Historically, bonds and money-market instruments diversify equity-like risk. They often move inversely to risk assets during stress, and pricing is tightly linked to interest rates:

- When rates rise, existing bond prices tend to fall (newer bonds pay more, so older ones are worth less).

- When rates fall, bond prices tend to rise (their fixed coupons look more attractive).

Tokenized Treasuries and money-market funds bring that same rate-sensitive, defensive profile on-chain, which is why RWAs can soften portfolio swings when crypto risk sells off.

The Bigger Picture: Flight to Quality in Real Time

During crisis cycles, capital seeks safety and liquidity. For the first time, that flight to quality has an on-chain destination.

Institutions are now rotating into RWAs as tokenized yield instruments that outperform both DeFi lending rates and centralized savings products.

IXS Perspective: Building the Institutional Settlement Layer

At IXS Finance, we see RWAs as the structural foundation for the next era of blockchain-based finance. Our mission is to make that infrastructure compliant, liquid, and accessible at scale.

By enabling institutions to tokenize, trade, and settle RWAs through our licensed framework, IXS is creating the bridge that allows:

- BTC and crypto treasuries to earn real-world yield without leaving the chain

- Asset managers to unlock liquidity from previously illiquid instruments

- Investors to diversify beyond crypto-native risk, without leaving Web3

The October crash didn’t just shake markets, it reshaped narratives. In 2025’s volatility, RWAs proved their institutional value. As capital searches for safety without sacrificing innovation, tokenized assets are becoming the anchor in the digital ocean.

Add institutional RWAs to your crypto stack today. Buy tokenized Treasuries, corporate bonds, and private equity directly through IXS - https://app.ixs.finance/

IXS Finance

The Institutional Exchange Settlement Layer powering compliant RWA tokenization and Bitcoin Real Yield.